The Single Strategy To Use For Multi Peril Crop Insurance

Wiki Article

The Main Principles Of Multi Peril Crop Insurance

Table of ContentsThe Best Guide To Multi Peril Crop InsuranceThe Basic Principles Of Multi Peril Crop Insurance Examine This Report about Multi Peril Crop InsuranceThe Ultimate Guide To Multi Peril Crop InsuranceAbout Multi Peril Crop Insurance

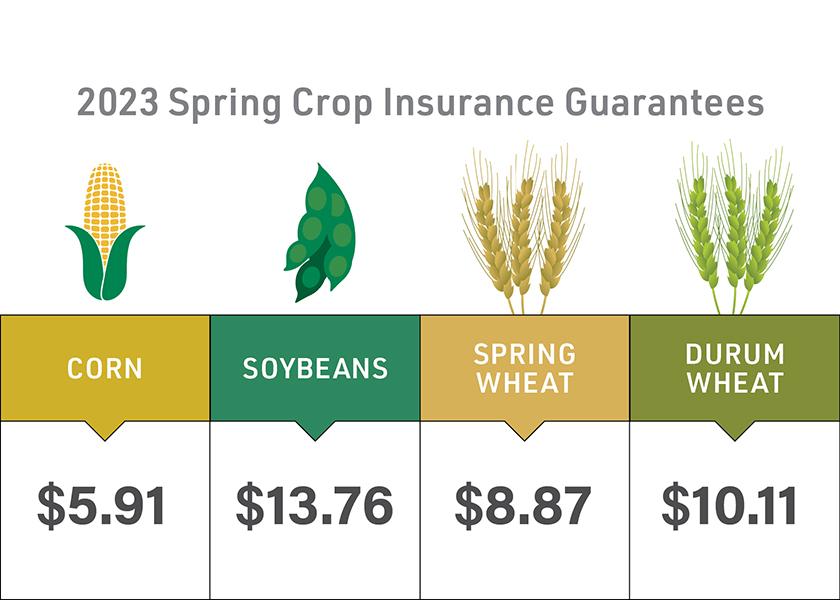

The crop insurance coverage under FCIP are known are multiple-peril farming insurance plan and are based on yield or earnings. Not all plants are insured by these plans. While the federal-government problems discover relating to the crops to be guaranteed for each and every various other, the most typically insured plants consist of corn, cotton, soybeans, and also wheat while several various other plants may be insured where they are discovered extra generally.

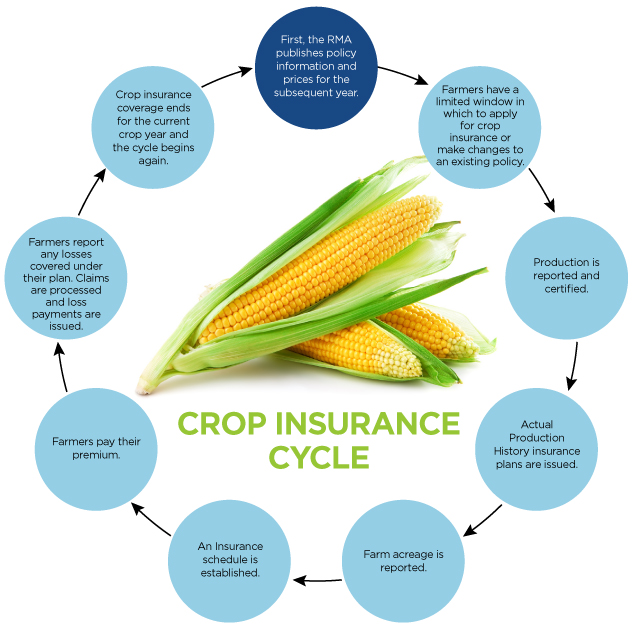

It is comparative with this recommendation as well as by utilizing the government market value of the plants that declares can be made and also protection is distributed. It is worth bearing in mind that farmers ought to acquire multiple-peril insurance coverage plans prior to growing the plants prior to the deadline or the sales closing date (SCD).

Facts About Multi Peril Crop Insurance Uncovered

Different from the FCIP Insurance policy plans, Plant hail insurance policy is not related to the government and also is completely marketed by personal companies that can be acquired at at any time throughout the crop cycle. Hail storm insurance coverage, unlike the name suggests, covers plants from threats besides hail like fire, lightning, wind, vandalism, and so on.When becoming part of the agreement with the insurance companies, farmers select the volume of the return to be insured (which could be between (50-85)% depending upon demands) in addition to the security rates of the federal government. While MPCI makes use of the referral return obtained from the historic information of the farmers to figure out the loss, Group-Risk-Plan (GRP) makes use of an area yield index.

Since these computations can take time, the time of settlement upon claims can take even more time than MPCI settlements. Revenue Insurance policies, on the various other hand, provide defense against a decrement in created earnings which may be an outcome of loss of production along with the change in the market rate of the crops, or also both.

Multi Peril Crop Insurance Can Be Fun For Anyone

This sort of policy is based on offering protection if and when the typical county earnings under insurance drops listed below the income that is selected by the grower. Plant insurance coverages are vital to the monetary sustainability of any type of farmland. The basic principle of agriculture insurance is as simple as it my review here is needed to understand, choosing the ideal kind of insurance that fits your particular demands from a huge selection of insurance coverage policies can be a tough task.However, it is essential to note that coverage for drought may have certain limitations or requirements. The policy could have specific criteria pertaining to the extent as well as period of the dry spell, as well as the influence on plant production. Farmers must very carefully evaluate their insurance policy and speak with their insurance coverage representative to understand the go to this website degree of coverage for dry spell and also any other weather-related threats.

Mark the broken area areas after a weather calamity or a disease or a bug strike as well as send records to the insurance.

An Unbiased View of Multi Peril Crop Insurance

For a thorough summary of specific insurance coverages, limitations and exclusions, please describe the policy.

Wonderful point. And also there's some other things that should take into consideration things like the farm machinery as well as the devices, just how much protection you need for that? Just how much is it worth? What are some various other points to think about right here in our last few mins, a few other things to think of besides just these top 5? Among things that I assume concerning a great deal is your automobiles.

Our Multi Peril Crop Insurance PDFs

Or if you do move it to a ranch automobile policy, usually on a farm vehicle policy, your liability will start higher. One of the reasons we consider that as well, and also why we write the greater limitations is since you're not only utilizing that vehicle or you might not simply possess that lorry individually, however if you are a farmer and that is your income, having something that can return to you, that you are liable for, having those greater restrictions will certainly not just safeguard you as as an individual, yet will certainly assist shield that ranch as well.

That can go on the homeowner's policy. But when your farm equipment is used for more than simply maintaining your residential or commercial property, after that you really do intend to include that kind of machinery to a farm plan or you intend to aim to getting a farm plan. I have farmers that guarantee things from tractors to the irrigation tools, hay rakes, combine, many various points that can be covered individually.

Report this wiki page